SEMPLIFICA IL TUO TRADING

100% AUTOMATICO / 0% STRESS

SEGUI UN PROFESSIONISTA

easylife

Grazie al CopyTrading potrai replicare automaticamente le strategie dei miei migliori Portafogli Algoritmici

(Versione presentata: Giugno 2025)

easylife original

easylife original è il nostro primo prodotto aperto al pubblico,

nato a ottobre 2022. Inizialmente era un singolo Trading

System multi-simbolo su 15 coppie forex. Oggi si è evoluto

in un portafoglio estremamente più complesso ed avanzato.

easylife infinity

easylife infinity è il nostro secondo prodotto, nato a settembre 2023,

con l’obiettivo di creare diversificazione per il nostro pubblico. Il nome

deriva dal fatto che il sistema inizialmente integrava un trailing stop

dinamico sulle posizioni e sulle mediazioni. Anche questo prodotto, ad

oggi, è diventato un portafoglio e non più un singolo Trading System.

easylife serenity

easylife serenity è l’ultimo nato della famiglia easylife a

inizio 2025, con l’obiettivo di portare ulteriore diversificazione al nostro

pubblico. Il terzo portafoglio, fratello dei primi due, ripropone la stessa

composizione di Trading System, ma con ottimizzazioni differenti e

un moltiplicatore delle mediazioni più leggero e conservativo.

Minimo capitale consigliato 2500€

No costi fissi, solo Performance Fee

8 Trading System 100% automatici

5 anni di Backtest, 2 anni Live

Nessuna VPS necessaria

Nessun vincolo, assistenza diretta

Minimo capitale consigliato 2500€

Nessuna VPS necessaria

8 Trading System 100% automatici

5 anni di Backtest, 2+ anni Live

No costi fissi, solo Performance Fee

Nessun vincolo, assistenza diretta

Affiliazione

Vuoi offrire alla tua clientela un servizio di Trading efficace, testato, pronto all’uso?

Contattami per poter offrire easylife al tuo pubblico e creare un rapporto win-win

- Prodotto senza pari sul mercato Forex/CFD

- 100% automatico per te e per il cliente finale

- Divisione della Performance Fee immediata

- Possibilità di rapporto IB con il Broker

- Nessuna VPS, nessuna installazione

Cos’è e perché il Forex?

Il Forex non è nient’altro che il mercato globale di negoziazione tra le valute delle varie nazioni, per questo si parla di “coppie” come ad esempio EUR-USD ovvero Euro scambiato con Dollaro Americano, GBP-USD ovvero Sterlina Britannica con Dollaro Americano, ecc.

Esattamente come quando ci si fa cambiare i soldi in valuta estera all’aeroporto si può realizzare un guadagno o una perdita facendo lo stesso scambio al contrario lasciando trascorrere del tempo.

Sapere come fare un’operazione di Trading non è facile, per questo occorre una profonda conoscenza del mercato.

Utilizzare un portafoglio di Trading System completamente automatico appositamente programmato e studiato per lavorare sul Forex, può essere al giorno d’oggi un ottimo investimento o diversificazione per il proprio futuro.

Cos’è easylife?

Il mondo del Trading e della finanza è complesso, pieno di insidie, truffe e false promesse di guadagni facili.

easylife nasce per offrire un’alternativa seria e sostenibile, mettendo a disposizione un portafoglio di Trading System sviluppato e gestito da un professionista con esperienza e risultati reali dimostrabili ottenuti nel corso degli anni. Ogni Sistema all’interno del portafoglio è ideato, codificato, testato e ottimizzato da me personalmente. L’intera operatività viene costantemente monitorata e aggiornata periodicamente per garantire prestazioni e affidabilità.

Con easylife, non ci sono promesse irrealistiche, solo un approccio metodico e professionale basato su numeri e statistica, pensato per chi cerca una crescita costante e una gestione del rischio solida.

L’accesso viene fornito in modalità CopyTrading (stile “eToro”) pertanto il cliente finale non deve occuparsi di nulla, il tutto viene interamente gestito dal software e dall’intermediario autorizzato.

Nato a inizio 2022 come singolo Trading System, oggi easylife è diventato, dopo numerosi aggiornamenti e implementazioni, un vero e proprio portafoglio diversificato e decorrelato. Tutti i Sistemi sono sviluppati su MetaTrader 5 con backtest pluriennali real-tick su coppie Forex major e minor e sono soggetti ad una progressiva evoluzione in base alle novità della ricerca e alle condizioni di mercato. Ogni Sistema del Portafoglio prima di essere utilizzato su conti Live deve: superare rigidi test su dato storico conosciuto (in-sample) e su dato futuro (out-of-sample), rispettare parametri di return-drawdown ratio, win-rate e altre metriche statistiche. Grande attenzione è dedicata a evitare l’overfitting dei sistemi, garantendo così un solido vantaggio statistico.

easylife è in grado di analizzare automaticamente il calendario economico potendo sospendere il Trading su Pair interessanti impattanti notizie macroeconomiche, per poi riattivarsi in condizioni di mercato adeguate. Il portafoglio è dotato di un decorrelatore dinamico per evitare un’eccessiva esposizione su coppie diverse legate alla stessa valuta

A chi si rivolge il servizio?

- A chi cerca una strategia 100% automatica

- A chi vuole affidarsi ad un professionista dimenticando ogni difficoltà

- A chi vuole diversificare il proprio portafoglio di investimenti

- A chi cerca un servizio tecnologicamente all’avanguardia

- A chi ha prospettive serie e realistiche e non cerca i “soldi facili”

- A chi ha un orizzonte temporale di medio-lungo termine (1+ anni)

- A chi cerca un servizio regolato e trasparente, senza costi nascosti e senza vincoli

Perché il CopyTrading e non l’EA in vendita?

easylife non è un classico Trading System “Plug and play”, ma un vero e proprio portafoglio in costante evoluzione, l’installazione e la gestione da parte di un utente diverso dal programmatore stesso sarebbe pertanto impossibile.

Inoltre, il CopyTrading ha numerosi vantaggi sia per il cliente sia per fornitore del software.

Per il cliente:

- È un servizio molto più etico, in quanto non ci sono i classici costi iniziali di acquisto piuttosto onerosi di un Trading System, l’accesso al servizio è gratuito e si paga solo una percentuale sugli eventuali profitti realizzati.

- Il tutto può essere gestito in modalità anonima senza contatto tra cliente e fornitore.

- Non occorre alcun setup e installazione del software, librerie, piattaforme, ecc.

- Non c’è bisogno di noleggiare una VPS (Virtual Private Server) o tenere un PC acceso 24 ore su 24 per eseguire il Sistema.

- Non c’è bisogno di controlli e manutenzioni in caso di problemi sul sistema operativo, assenza di connessione, blackout o aggiornamenti.

- Il cliente è libero di interrompere il CopyTrading in qualsiasi momento, senza vincoli con il fornitore e senza aver pagato per qualcosa che non userà più.

Per il fornitore:

- È molto più incentivato a mantenere un servizio efficiente, in quanto senza performance positive non ha utili.

- È libero di aggiornare e modificare i Sistemi in corso d’opera senza dover far intervenire il cliente.

- La proprietà intellettuale sui software è tutelata da hacking e pirateria informatica.

Trasparenza dei costi

Credo nell’etica anche nel Trading. Per questo ho deciso di concentrarmi unicamente sulla Performance Fee, calcolata sull’High-Water Mark (HWM). Questo significa che mi viene corrisposta una percentuale solo se prima genero un profitto per te.

La tua percentuale sui guadagni che genera easylife.

- Zero costi di registrazione

- Zero costi fissi - No Management Fee

- Zero costi sui volumi - No Volume Fee

- Zero penali di annullamento

- Nessuna VPS

Accedi al canale Telegram

Accedi al canale Telegram dove troverai tutte le ultime novità su easylife, comunicazioni e analisi

Guarda gli storici certificati myfxbook

Le performance possono risultare diverse tra i vari conti per le differenze tra i Broker utilizzati, la data di avviamento, il profilo di rischio adottato e altri fattori.

Portafoglio algoritmico 100% automatico di Trading System easylife

Investor password fornite su richiesta

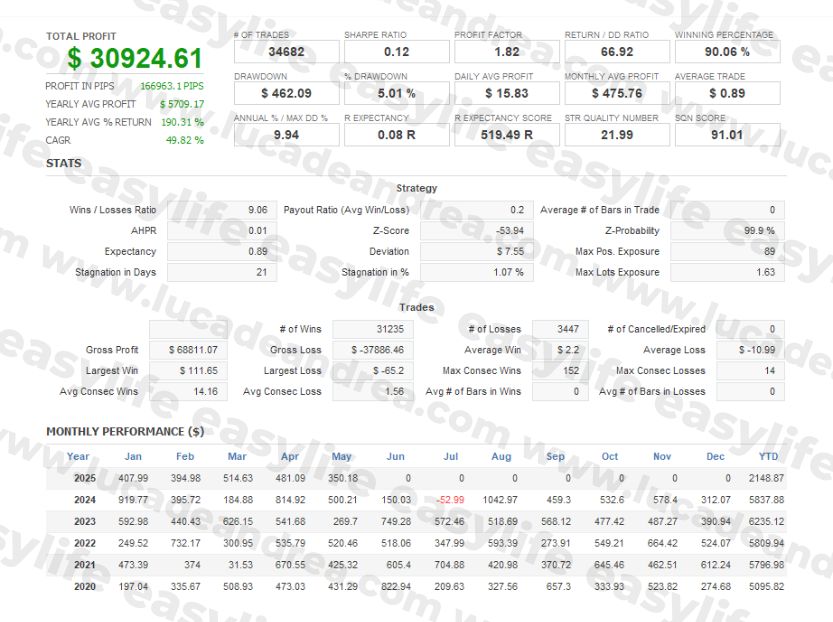

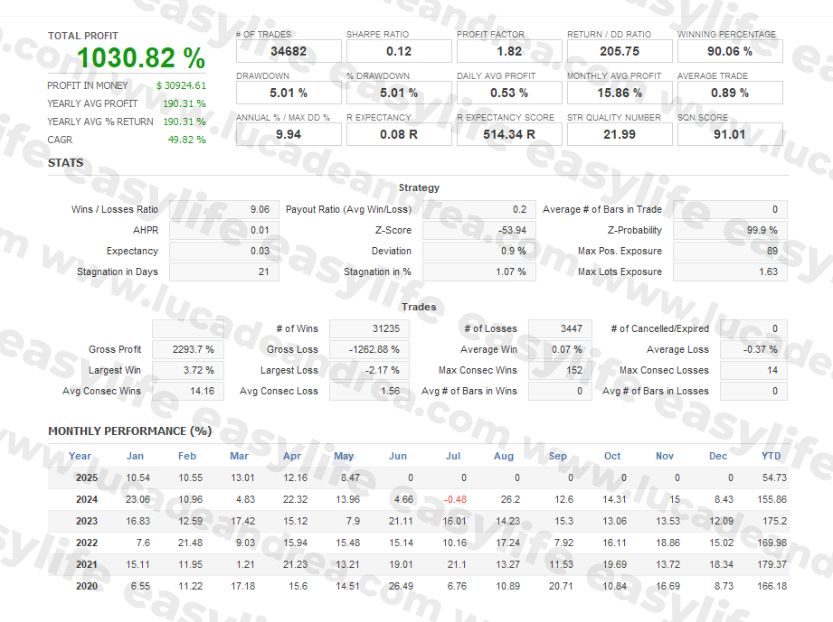

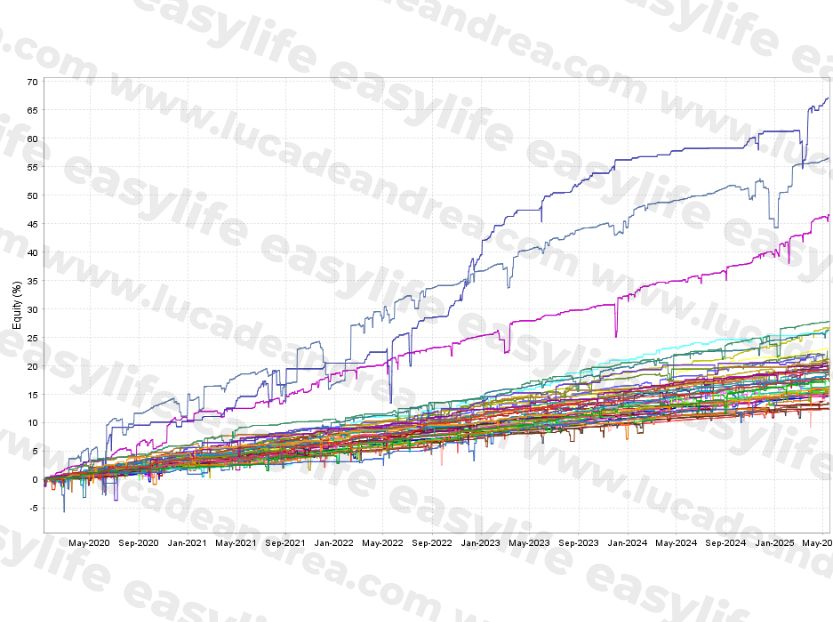

Backtest easylife original

(Versione presentata: Giugno 2025)

Backtest effettuato dal 06/01/2020 al 16/05/2025 (5+ anni) su MT5, 8 Trading System, 40 chart attivi.

Capitale iniziale $ 3000, capitale finale $ 30924 (+1030%). Senza utilizzo interesse composto, Lot Size fissa ordine base 0.01 Lotti.

Massimo Drawdown relativo $ 462.

(Si ricorda che il Backtest è una simulazione su dati storici, non sono performance ottenute su denaro reale).

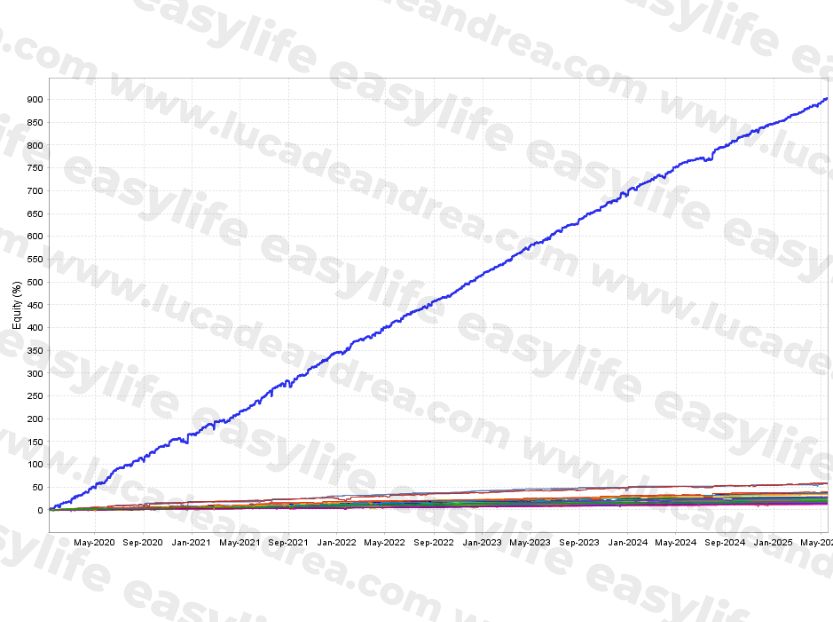

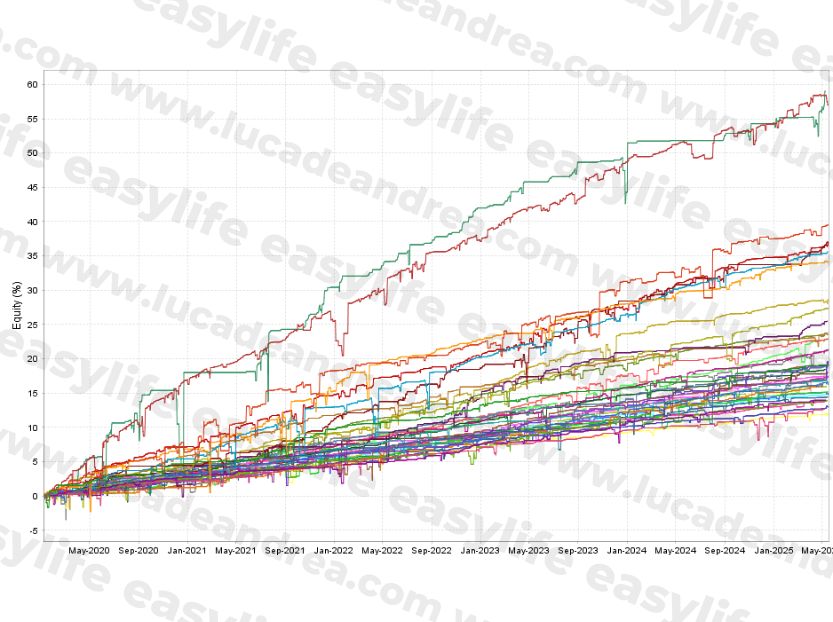

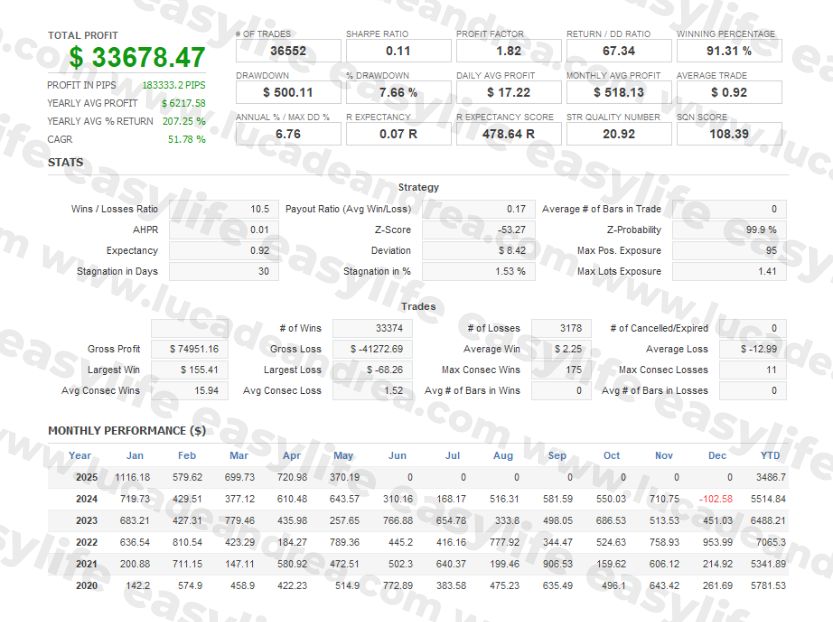

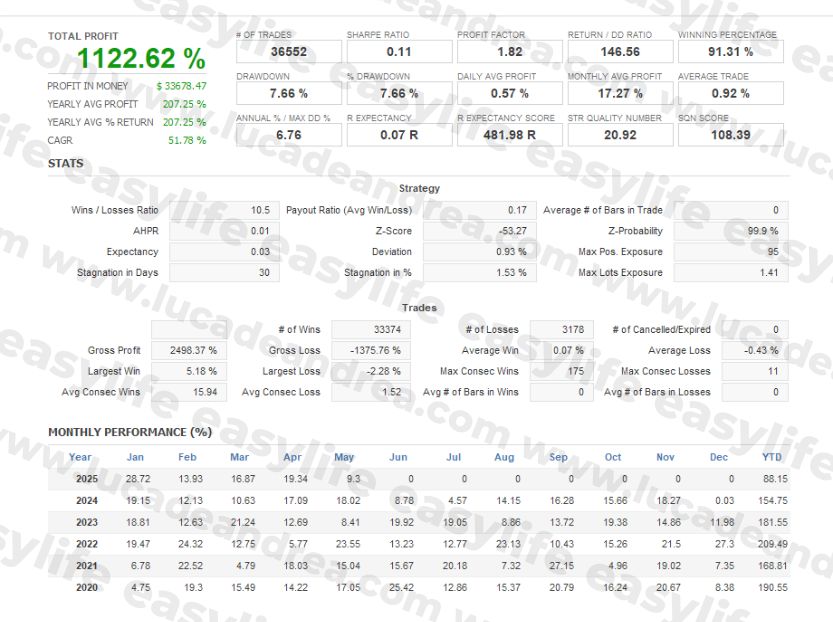

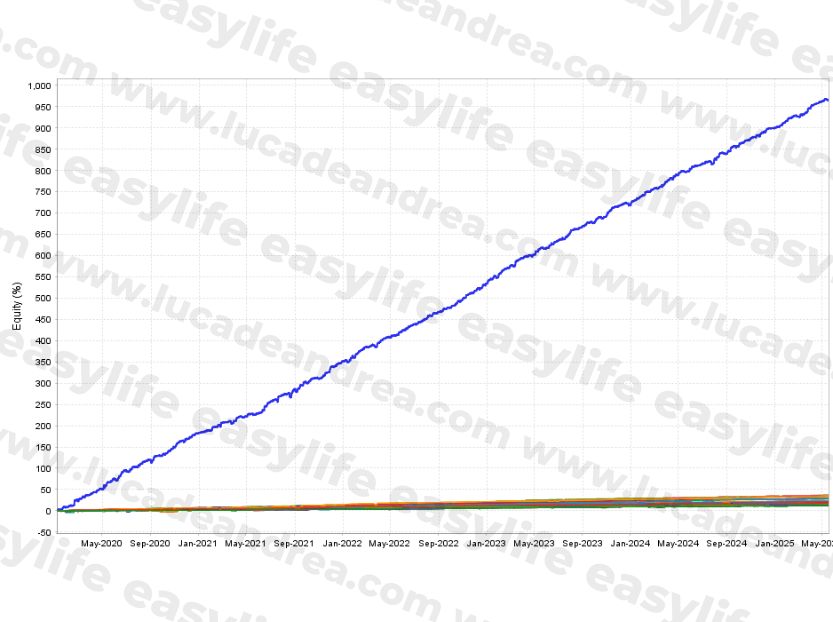

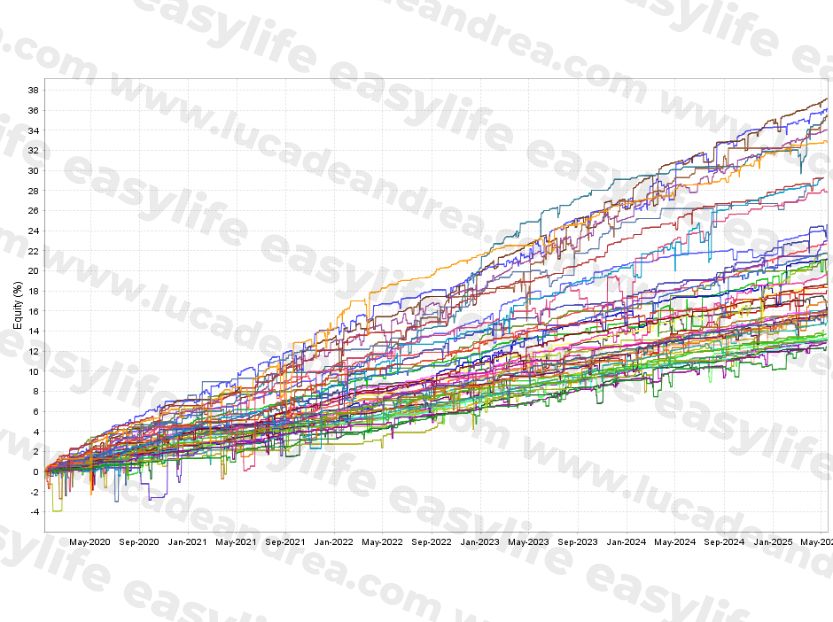

Backtest easylife infinity

(Versione presentata: Giugno 2025)

Backtest effettuato dal 06/01/2020 al 16/05/2025 (5+ anni) su MT5, 8 Trading System, 48 chart attivi.

Capitale iniziale $ 3000, capitale finale $ 33678 (+1122%). Senza utilizzo interesse composto, Lot Size fissa ordine base 0.01 Lotti.

Massimo Drawdown relativo $ 500.

(Si ricorda che il Backtest è una simulazione su dati storici, non sono performance ottenute su denaro reale).

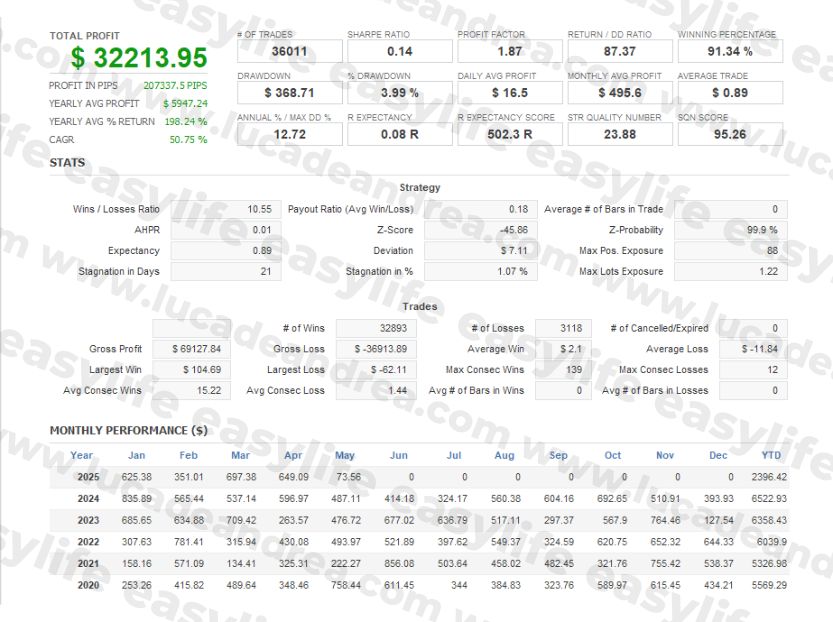

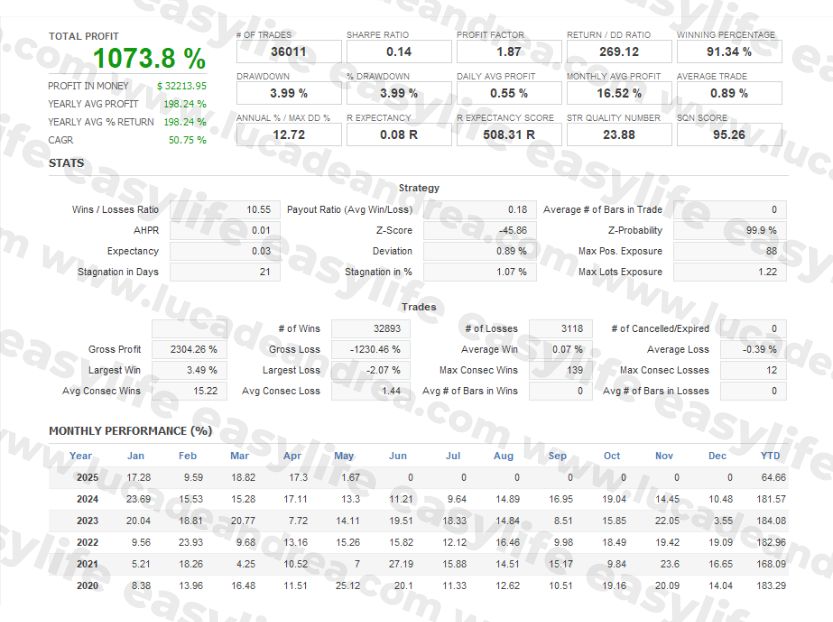

Backtest easylife serenity

(Versione presentata: Giugno 2025)

Backtest effettuato dal 06/01/2020 al 16/05/2025 (5+ anni) su MT5, 8 Trading System, 48 chart attivi.

Capitale iniziale $ 3000, capitale finale $ 32213 (+1073%). Senza utilizzo interesse composto, Lot Size fissa ordine base 0.01 Lotti.

Massimo Drawdown relativo $ 368.

(Si ricorda che il Backtest è una simulazione su dati storici, non sono performance ottenute su denaro reale).

FAQ

Il servizio non prevede costi di attivazione.

Una volta avviato il CopyTrading, solo sui guadagni netti il fornitore del servizio (Spotware o FP Markets) trattiene e corrisponde al fornitore di strategia una Performance Fee del 50%.

La Performance Fee è calcolata sulla logica di High-Water Mark, ovvero ogni qual volta viene realizzato un nuovo massimo sull’equità del conto. L’High-Water Mark (HWM) garantisce commissioni solo per i profitti che hai effettivamente generato e che non si sovrappongano ai profitti di periodi precedenti.

Durante eventuali periodi di drawdown non viene trattenuta alcuna somma.

Gli unici altri costi sono quelli del mercato CFD quali Spread e Commissioni presenti in qualsiasi tipo di operazione finanziaria.

Per lavorare con un profilo conservativo si suggerisce un capitale dai € 2500 a salire.

Con capitali maggiori sarà possibile adattare proporzionalmente l’esposizione a mercato.

I guadagni dipendono dal capitale investito e dal profilo di rischio adottato.

Sono disponibili i vari storici myfxbook e backtest sopra riportati per analizzare come ha performato il software in passato.

Occorre ricordare che le performance passate non sono indicative di risultati futuri.

Non c’è nessun vincolo tra il cliente e il fornitore di strategia. Il cliente è libero di avviare, sospendere e interrompere la copia in qualsiasi momento.

Il capitale è prelevabile in qualsiasi momento.

Non occorre alcuna comunicazione al fornitore per l’interruzione del servizio.

Occorre investire un capitale a basso rischio con un orizzonte temporale di minimo 1 anno. Solo così sarà possibile vedere i frutti del lavoro fatto dal sistema.

Attualmente le migliori condizioni sono state trovate tramite:

MetaTrader 5 sul broker FP Markets, servizio di Social Trading.

Tutti i dettagli sull’accesso vengono forniti in fase di contatto.

Certamente, tramite la MetaTrader 5 per mobile o desktop.

No, il CopyTrading lavora in Cloud. Per il cliente è sufficiente avviare il servizio sul Broker e le operazioni verranno automaticamente replicate sul suo conto. Tramite la MetaTrader 5 o cTrader per mobile o desktop sarà possibile monitorare l’andamento.

Sì, è possibile andare a sfruttare i guadagni fatti per incrementare l’esposizione a mercato. Contattami per maggiori informazioni.

No. Il capitale del cliente non viene consegnato in mano a un gestore, ma bensì viene depositato dal cliente stesso su un conto Trading di sua unica proprietà ed accesso. Il cliente, di sua libera iniziativa, decide di registrarsi ad un servizio di replica di operazioni di Trading da un altro Conto Trading offerto come Strategy Provider dal Broker, regolamentato a erogare questo tipo di servizio. Il cliente accetta i Termini e Condizioni del servizio del Broker.

Il capitale resta nelle mani del cliente, che è libero di avviare la copia, sospenderla e interromperla in qualsiasi momento. Il servizio può essere avviato anche in modalità totalmente anonima senza contatto tra cliente e fornitore.

L’interruzione del servizio non richiede alcuna comunicazione al fornitore di strategia e non prevede alcun vincolo o penale.

Il capitale può essere prelevato in qualsiasi momento, interamente o parzialmente.

La modalità di rischio a cui far lavorare il CopyTrading è decisa dal cliente, con possibilità di impostare uno Stop Loss facoltativo a propria discrezione.

Il fornitore di strategia non ha in alcun modo accesso ai fondi del conto Trading del cliente, né ai suoi dati personali.

Come riportato nel punto precedente, sì. Si tratta di un’operazione di CopyTrading offerta da un intermediario abilitato a questo tipo di servizio provvisto delle licenze necessarie, in questo caso FP Markets o Spotware. Il fornitore di strategia non è, e non necessita di essere, un consulente finanziario o altro tipo di entità. Non c’è alcuna gestione patrimoniale e/o consiglio finanziario personalizzati.

Il cliente di sua libera iniziativa decide di avvalersi di questo servizio accettando i Termini e Condizioni dello stesso, potenzialmente anche in modalità anonima verso il fornitore di strategia.

Il capitale resta sempre nelle mani del cliente su un Conto Trading di suo unico ed esclusivo accesso, senza alcun vincolo alla strategia.

FIRST PRUDENTIAL MARKETS LTD è presente nell’elenco delle Imprese di Investimento Autorizzate In Altri Stati UE senza succursale In Italia con N. iscrizione all’elenco: 5035

No. Non esistono investimenti sicuri, non viene promessa alcuna percentuale mensile o annuale. L’intero capitale come in ogni investimento è a rischio, pertanto occorre investire solamente una somma che nel caso vada persa non impatti economicamente la propria condizione.

Chiunque prometta guadagni sicuri e costanti sta promettendo il falso.

Il fornitore consiglia un profilo di rischio basso e conservativo.

Il fornitore si impegna comunque a mantenere il servizio performante e aggiornato nel tempo. In caso di insoddisfazione il cliente sarà libero di interrompere il servizio senza costi e/o penali.

Tutti gli utenti sono responsabili della valutazione, selezione e monitoraggio dell’idoneità di ogni conto copiato e delle prestazioni complessive del fornitore di segnali su CopyTrading, in base alla propria tolleranza al rischio.

Per offrire il servizio, come ovvio che sia, bisogna appoggiarsi ad un intermediario che abbia le regolamentazioni e la strumentazione necessaria.

Per quanto riguarda FP Markets, il Broker è stato scelto dopo prove personali pluriennali, verifiche della solidità dello stesso, costi di transazione, dimensioni aziendali, sicurezza e tutela dei fondi, qualità dell’assistenza, velocità dei prelievi, flessibilità della piattaforma di CopyTrading. Se in futuro venissero identificate condizioni migliori su altri Broker, il servizio potrà essere offerto anche altrove.

Qualora il conto fosse sul broker FP Markets-Live, sì. Diversamente non è possibile in quanto il servizio viene offerto grazie al Social Trading di FP Markets

Il Portafoglio viene costantemente monitorato e vengono condotti test per valutare possibili migliorie tecniche o di performance. Nel caso di modifiche o novità viene avvisata la clientela sul canale ufficiale Telegram. In ogni caso, lato cliente non è necessaria nessuna azione.

Dal lancio, la strategia ha visto numerosi aggiornamenti, evolvendosi costantemente fino a diventare un vero e proprio portafoglio diversificato e decorrelato.

Si tratta di un portafoglio di Trading System con logica dollar-cost averaging (DCA) basato su indicatori tecnici per individuare situazioni di ingresso in contro-trend. Il sistema ha un ristretto livello di Take Profit, in caso di mercato in direzione contraria si lavora in mediazione e Stop Loss.

Si consiglia una size molto conservativa.

Il sistema potrà essere modificato e aggiornato nel tempo dal fornitore di strategia.

In orario diurno, il Portafoglio viene supervisionato da occhio umano. Inoltre, sono previsti numerosi filtri quali filtro News, filtro Spread, filtro volatilità, orari operativi, ecc per salvaguardare il Sistema da condizioni anomale. Le VPS ad alte prestazioni di esecuzione del Portafoglio sono monitorare h24 tramite Alert e sistemi di disaster-recovery.

Tecnicamente sì, ma è sconsigliato per non interferire con l’operatività in copia.

Un Trading System è un software programmato appositamente per operare sui mercati finanziari in modo automatico.

Entrambi gli intermediari fornitori del servizio di CopyTrading richiedono per l’iscrizione la maggiore età (18+)

Contattami ai recapiti che trovi nell’apposita pagina